Performance Media Most Critical in Today’s Economic Climate, Marketers Say

Marketing industry constituents consider performance-driven paid media to be a more important investment than brand advertising given current macroeconomic conditions. But in an interesting twist, both are rising in importance rather than moving in opposite directions, according to the latest bi-annual study from Mediaocean.

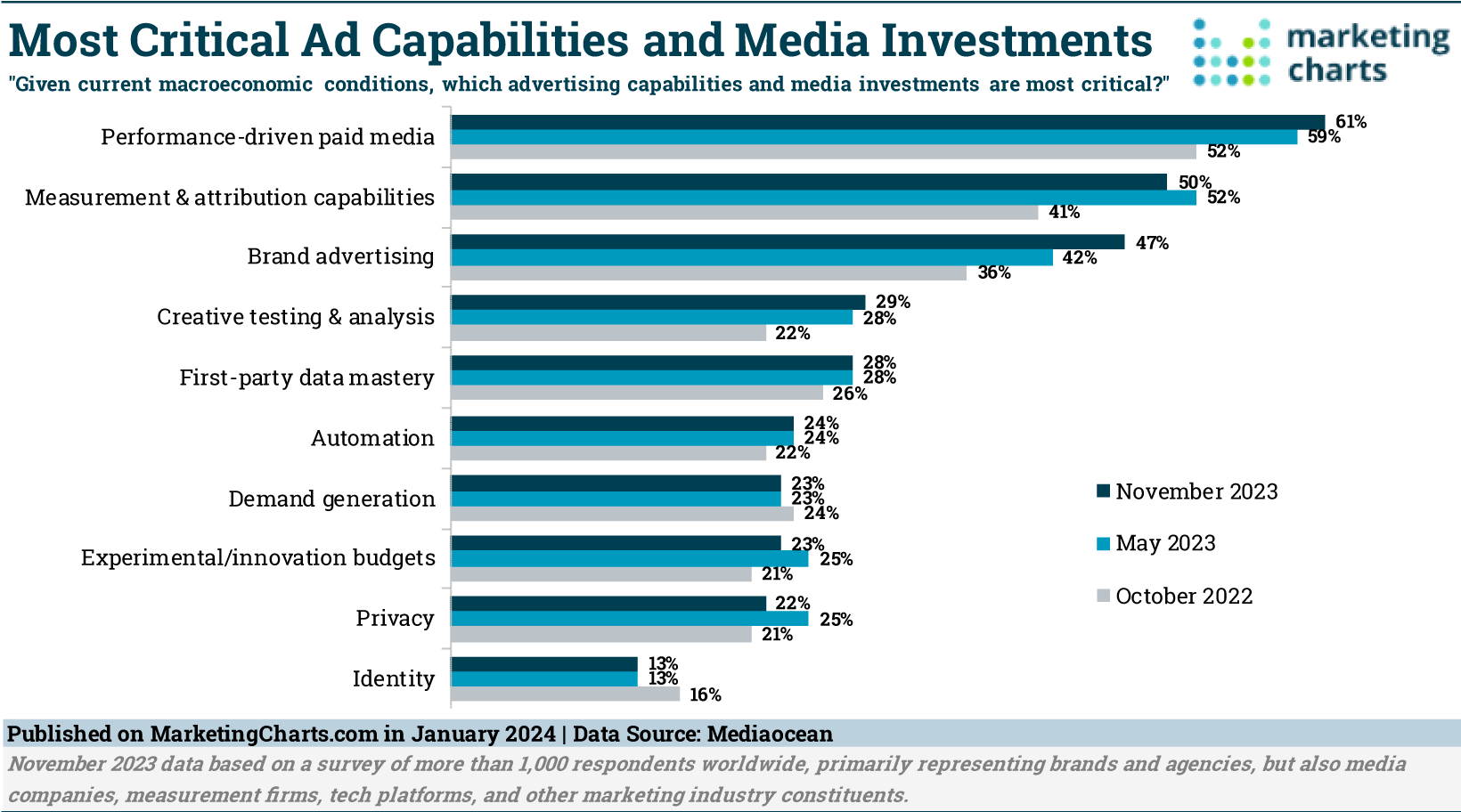

Mediaocean surveyed more than 1,000 marketing industry constituents around the world in November 2023, asking them which advertising capabilities and media investments they considered most critical given current macroeconomic conditions. It then compared the responses to those found in May 2023 and October 2022 surveys.

In the latest survey, performance-driven paid media was again deemed the most critical, as cited by 61% of respondents, up from 59% in the May 2023 survey and 52% in the October 2022 edition.

Not far behind, though, brand advertising was cited by almost half (47%) of respondents. Brand advertising appears to also be becoming more critical in the eyes of industry constituents, as the 47% result was up from 42% in the prior survey and 36% in the year-earlier edition.

The results bring to mind recent research, in which 75% of CMOs arpund the world agreed that they should double down on performance at the same time that 77% agreed that they should focus their attention on brand. To which the analysts at Dentsu Creative, which conducted the survey, said “that there can no longer be a question of either/or.”

Top Concerns in 2024

The ranking of marketing industry constituents’ top concerns this year remain similar to those gathered in mid-year 2023, though with a couple of changes from the late 2022 edition of the study.

Among respondents surveyed late last year, a leading 43% said that a decline in the ability to measure campaign effectiveness on tech platforms and the open web is among their largest areas of concern in their media and marketing initiatives.

Close behind, 39% tabbed lack of preparedness for cookieless future and other data deprecation relating to consumer privacy and walled gardens as an area of concern. This was the top concern among respondents to the late 2022 survey looking ahead to 2023. Perhaps it will grow in importance this year given that Google has now finally begun the process, unless the industry is feeling like it has adequately prepared for the inevitable...

Meanwhile, the third-largest area of concern among those listed is consumer ad avoidance / ad blindness, with 37% pointing to this in late 2023, up from 29% in late 2022. Recent research suggests that ad avoidance is most common on free with ads video services and least prevalent when consumers are listening to podcasts.

About the Data: The results are based on a November 2023 survey of more than 1,000 respondents worldwide, primarily representing brands and agencies, but also media companies, measurement firms, tech platforms, and other marketing industry constituents.

Full article here: https://www.marketingcharts.com/advertising-trends-231840?mc_cid=6790765266&mc_eid=7ae3dee024