How consumers find new brands and products on social media, marketplaces, and brick-and-mortar retail in 5 charts

Social media is important in product discovery, especially among younger consumers, but it’s only part of the picture—marketplaces, search engines, and brick-and-mortar retail also influence where and how consumers find new products.

Here are five charts on what brands need to know about product discovery across digital and physical channels.

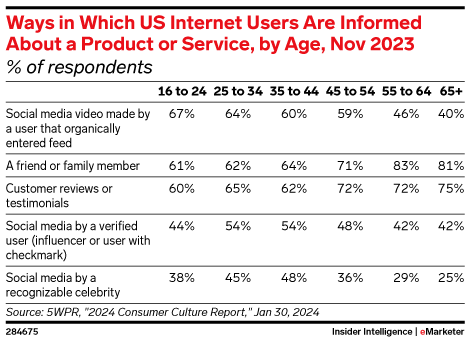

1. Younger consumers turn to social media, family, and friends

Over two-thirds (67%) of US 16-to 24-year-olds say they’ve learned about a product or service through a social media video that organically entered their feed, according to a November 2023 survey from 5WPR.

However, nearly as many (61%) say they’ve discovered a product or service via a friend or family member. Word of mouth is still a powerful tool for brands.