US Offline Media Spend in 2023 and the Outlook for 2024

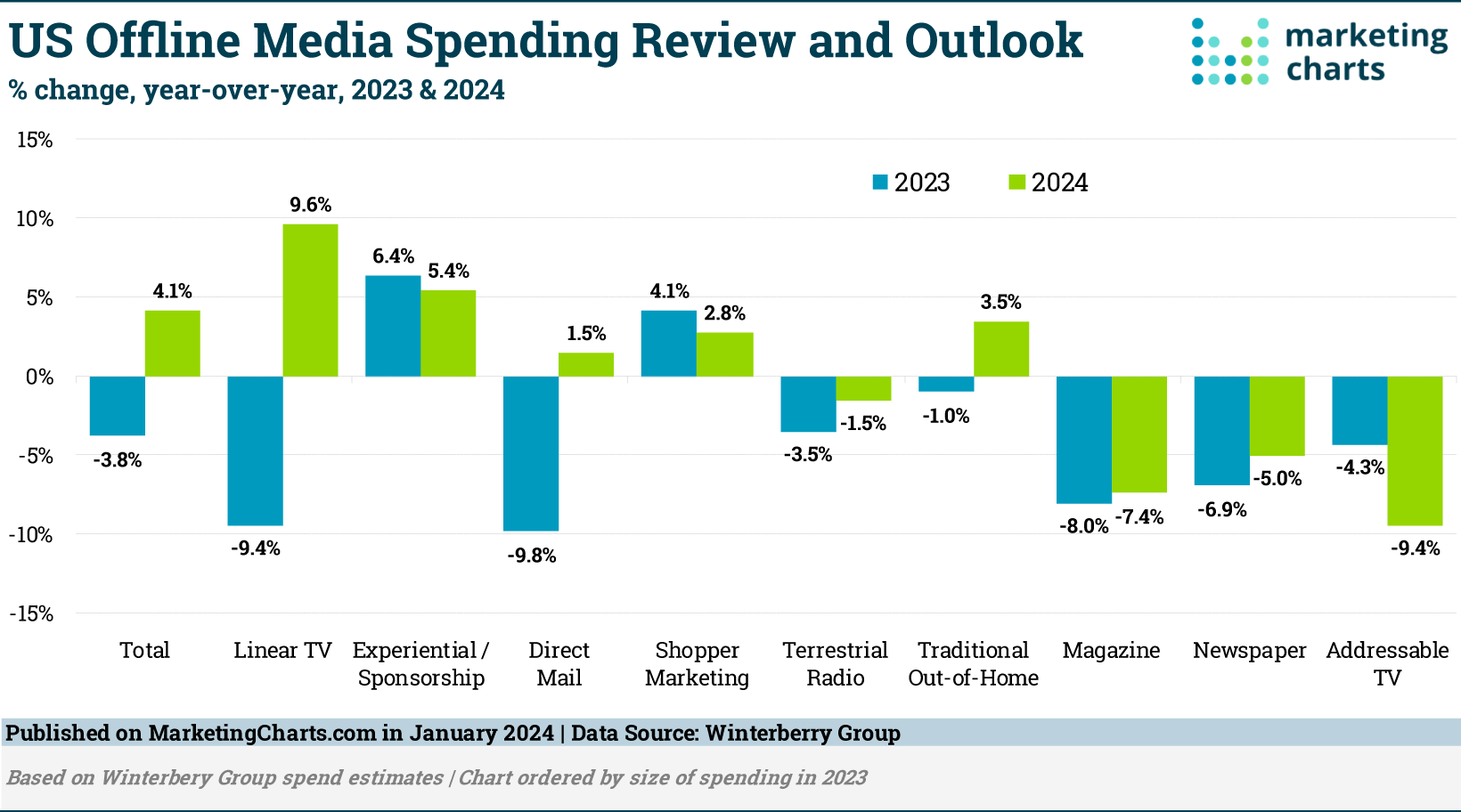

US advertising and marketing media spend grew by 5.1% year-over-year in 2023 to total $515.1 billion, a slower rate of growth than seen in 2022 and in 2021. Offline media was responsible in large part for the slowdown, as a “down year for offline” pushed spending down on these channels by 3.8% to $195.1 billion, erasing gains made in 2022, per a report from Winterberry Group.

Offline media’s drop in 2023 came after increases in the couple of years prior, in so doing bucking the 4-year compound annual growth rate (2020-2023: +2%). The trend away from investment in offline media continues, as offline media fell to roughly 37.9% share of total spend in 2023, down from 41.4% in 2022 and 49.9% in 2020.

This year, offline marketing spending is forecast to grow by 4.1% to $203.1 billion, boosted by political ad spending. However, online media spending is predicted to grow even more rapidly, such that offline’s share of the total will drop to 35.5%.

Here’s a rundown of offline channels in order of their total spend in 2023.

Linear TV

Linear TV ad spend continues to come under threat from digital alternatives such as connected TV (CTV). Last year, linear TV ad spend saw a fairly drastic drop of 9.4% to $55.7 billion, a larger fall than was expected. Still, that total was more than the combined total of $51.6 billion spent last year on digital video ($26.2 billion) and CTV ($25.4 billion), according to the report.

Linear TV will post a strong recovery in this election year, as the analysis predicts an increase of 9.6% to $61.1 billion, the fastest rate of growth forecast for any offline channel. Despite this, linear TV would fall behind the combination of digital video ($30.5 billion) and CTV ($33.1 billion), which are projected to have even larger increases in spend.

Experiential/Sponsorship

Experiential/sponsorship media spend continues to rebound after its precipitous decline in 2020, though its rate of growth is falling. After an impressive 27.6% year-over-year rise in 2021, spending on this channel rose by 13% in 2022, and last year expanded by 6.4%, making it the fastest-growing offline channel.

This channel is expected to see continued growth this year, with spend forecast to rise by 5.4% to $46 billion, the second-fastest rate of growth forecast for an offline channel (behind linear TV).

Direct Mail

Marketers have said they’ve increased their direct mail budgets, but this isn’t reflected in Winterberry Group’s data, which indicates an almost-double-digit 9.8% decrease in spending on this channel in 2023, to $37.6 billion. In so doing, direct mail failed to meet the analysts’ forecast spending for the year.

The forecast for this year is more upbeat for direct mail, reversing to a predicted growth of 1.5% to $38.2 billion.

Shopper Marketing

Accounting for $23.1 billion of spend in 2023, Shopper Marketing media, which includes merchandising, in-store displays, sampling, retail-specific coupons/offers and in-store events, grew by 4.1% from the year earlier. This was the only offline channel other than Experiential/Sponsorship Growth to expand last year.

Spending growth on Shopper Marketing is expected to slow this year, but will remain on the rise, predicted to climb by 2.8% y-o-y to reach $23.7 billion.

Radio

Radio continues to have the widest reach of any medium, and as such continues to be an attractive medium for advertisers. However, last year, terrestrial radio suffered a 3.5% decrease in spend to $11.8 billion, narrowing the gap with the amount spent on digital audio ($8.4 billion).

This year won’t bring renewed growth to the radio advertising market, despite the election year, with a projected 1.5% decline in radio ad spend to $11.6 billion.

Traditional Out-of-Home

US out-of-home (OOH) advertising spending (including digital OOH) has recovered to exceed pre-pandemic levels. While digital has powered the reversal of fortunes, traditional OOH has seen some minor gains. However, this report shows that traditional OOH marketing spend dipped last year by 1% y-o-y to $7.6 billion.

This year, however, should bring renewed growth, with a forecast increase of 3.5% being on the higher end of forecasts for offline media.

Magazines and Newspapers

Marketers invested $6.2 billion in print magazine media last year, a decline of 8% compared to 2022, a much worse result than expected (a 5% drop had been forecast). This year doesn’t look much better, with spending expected to drop by 7.4% to $5.8 billion.

Print newspaper media will see a smaller decline in spending this year (-5% to $5.8 billion, on par with print magazine spend), after also faring better than magazines last year, with a comparably smaller 6.9% drop in spend to $6.1 billion.

Addressable TV

After a banner year in 2022 (+24.3% growth), addressable TV fell back to earth last year, with a 4.3% drop in spending to $3.4 billion. This year, Winterberry Group predicts that addressable TV will have the worst outlook of all offline media, forecasting a 9.4% decline in expenditures to $3.1 billion.

Full article here: https://www.marketingcharts.com/advertising-trends/spending-and-spenders-231961?mc_cid=8d407ce775&mc_eid=7ae3dee024